Distributed Ledger is a decentralized database that stores transactions across multiple locations. It enhances transparency and security.

In the world of digital finance and technology, Distributed Ledger has emerged as a revolutionary concept. This decentralized database allows for transactions to be securely recorded across a network of computers, ensuring transparency and eliminating the need for a central authority to oversee transactions.

Distributed Ledger technology, most notably exemplified by blockchain, has the potential to revolutionize industries beyond finance, such as supply chain management, healthcare, and voting systems. This innovative technology is reshaping the way data is stored and shared, offering a more secure and efficient solution for recording transactions in today's digital age. As businesses and industries continue to adopt Distributed Ledger technology, its impact on improving security, transparency, and efficiency is becoming increasingly evident.

The Rise Of Distributed Ledger

Distributed Ledger technology is transforming traditional finance systems. It allows for secure, transparent, and decentralized record-keeping of transactions. By utilizing cryptography and peer-to-peer networks, distributed ledgers ensure immutability and reliability. This innovation is reshaping industries beyond finance, enabling efficient and trustworthy data sharing. As decentralized systems gain popularity, the adoption of distributed ledgers is continuously growing.

Credit: medium.com

Benefits Of Distributed Ledger

Distributed Ledger offers enhanced security, transparency, and cost-efficiency in managing transactions. It eliminates the need for intermediaries, reducing the risk of fraud and ensuring trust among participants. This innovative technology provides a decentralized approach to record-keeping and enhances data integrity.

| Enhanced Security Measures | Distributed ledger technology provides enhanced security measures through cryptography. |

| Improved Transparency and Efficiency | Improved transparency and efficiency are achieved by having a decentralized system. |

Impact On Financial Services

The distributed ledger technology has revolutionized payment systems in the financial services sector. It has introduced smart contracts and automation, making transactions more secure and efficient. Through this technology, financial institutions can streamline their processes, reduce the risk of fraud, and lower operational costs. Additionally, it has paved the way for faster cross-border transactions and improved transparency. Moreover, with the use of distributed ledger, financial services can provide better access to underbanked populations and enable new business models. This technology is reshaping the financial landscape, creating opportunities for innovation and growth.

Credit: www.mdpi.com

Challenges And Opportunities

The regulatory landscape poses significant challenges for distributed ledger technologies. Governments and financial authorities are grappling with the need to establish clear guidelines and frameworks to regulate the use of distributed ledgers. The complex nature of these technologies makes it difficult to devise appropriate laws and policies. Ensuring data privacy and security is a paramount concern that regulators must address. Additionally, cross-border regulation poses a challenge, as different jurisdictions may have conflicting laws and regulations. The pace of technological advancements requires regulators to constantly adapt and evolve to keep pace with emerging risks.

Potential For Financial Inclusion

Distributed ledger technologies hold substantial opportunities for financial inclusion. By removing intermediaries and enabling direct peer-to-peer transactions, distributed ledgers can lower costs and increase accessibility to financial services for individuals and businesses in underserved areas. This can promote economic empowerment and reduce inequality by providing a secure and transparent platform for financial transactions and services. Furthermore, distributed ledgers can enhance financial literacy and empower individuals to take control of their finances. Overall, the potential for financial inclusion through distributed ledgers is tremendous.

The Future Of Finance

Distributed ledger technology is revolutionizing the finance industry. Its integration with traditional systems is changing the way transactions are conducted and recorded.

This innovation offers a transparent and decentralized platform for financial transactions. It eliminates the need for third-party intermediaries, reducing costs and improving efficiency.

Distributed ledger technology is not limited to cryptocurrency transactions. Its expanding use cases include identity verification, supply chain management, and smart contracts.

With its immutable and tamper-proof nature, this technology has the potential to increase trust and security in financial transactions. Furthermore, it holds promise for reducing fraud and enhancing data privacy.

As businesses continue to explore and adopt this technology, the future of finance looks promising with distributed ledger technology leading the way.

Credit: www.frontiersin.org

Frequently Asked Questions On Distributed Ledger

What Is A Distributed Ledger?

A distributed ledger is a decentralized system of recording and validating transactions across multiple computers or nodes. It allows for transparent and secure storing of information, without the need for a central authority or intermediary. This technology has gained popularity due to its potential to enhance transparency and efficiency in a wide range of industries.

How Does A Distributed Ledger Work?

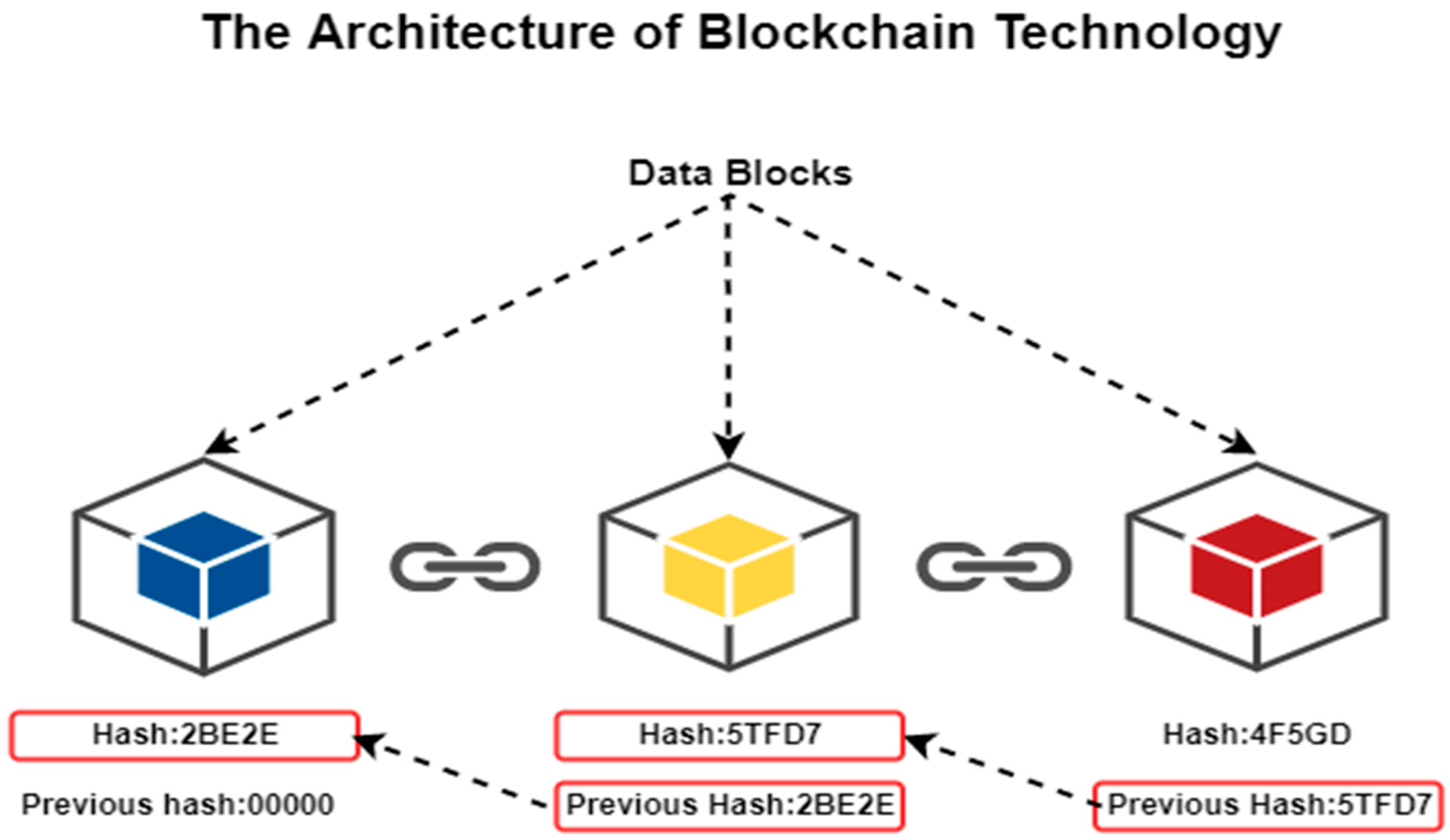

In a distributed ledger system, each participant maintains their own copy of the ledger, which is constantly updated and synchronized with other copies in the network. Transactions are grouped into blocks, which are then added to the chain of previous blocks to create an immutable record of all transactions.

Consensus algorithms ensure that all participants agree on the state of the ledger, adding an extra layer of security.

What Are The Benefits Of Using A Distributed Ledger?

Distributed ledgers offer multiple advantages over traditional centralized systems. They enhance transparency, as all participants can access and validate the same information. They also improve security, as the distributed nature of the ledger makes it difficult for hackers to tamper with the data.

Additionally, distributed ledgers can streamline processes, reduce costs, and facilitate trust between parties.

What Is The Difference Between A Distributed Ledger And A Blockchain?

While distributed ledgers and blockchains share similarities, they are not the same thing. In a distributed ledger, transactions are validated by consensus among participants, without the need for mining or a single global chain. On the other hand, a blockchain is a specific type of distributed ledger that utilizes a chain structure and proof-of-work or proof-of-stake mechanisms to validate transactions.

Conclusion

Distributed ledger technology offers secure and transparent record-keeping. Its decentralized nature empowers businesses and individuals to transact with confidence. The potential for reducing fraudulent activities and enhancing traceability is significant. Embracing this technology can revolutionize various industries, leading to more efficient and trustworthy operations.