State Farm Insurance in Austin, Texas offers great coverage and rates for auto, home, and tenant insurance. Local agents provide quick quotes for potential savings on insurance policies.

By switching to State Farm, customers can benefit from comprehensive coverage and excellent customer service. Whether you need auto, home, or tenant insurance, State Farm is a reliable choice with competitive rates and personalized service. With convenient online account management and local agents like Stuart Nalewaik, Brad Herrera, and Nancy Callahan, State Farm ensures a seamless insurance experience for all in Austin, Texas.

Contact a State Farm agent today and see how much you can save on your insurance needs!

Credit: m.facebook.com

Understanding State Farm Insurance

State Farm Insurance is a well-known insurance company that provides a wide range of insurance products and services. Understanding the offerings and the company's overview is essential for making informed decisions regarding insurance coverage.

Company Overview

State Farm Insurance, headquartered in Bloomington, Illinois, was founded in 1922 by George J. Mecherle. The company's current CEO, Michael L. Tipsord, continues the legacy of providing insurance solutions for individuals and businesses. With a strong presence across the United States, State Farm has built a reputation for reliability and customer-centric services.

Services Offered

State Farm offers a comprehensive range of insurance services, including auto insurance, home insurance, renters insurance, life insurance, and more. The company also provides financial services such as banking and investment products. With a network of local agents and digital services, State Farm ensures accessibility and personalized assistance for its customers.

State Farm's commitment to customer satisfaction and competitive rates makes it a preferred choice for various insurance needs. Understanding the diverse offerings and the company's consistent performance is crucial for individuals and businesses seeking reliable insurance coverage.

State Farm Insurance Rates

When it comes to State Farm Insurance Rates, it's crucial to understand the various factors influencing them. From comparison with competitors to the key determinants affecting the rates, let's delve deeper into the world of State Farm insurance pricing.

Comparison With Competitors

State Farm is known for offering competitive rates compared to its counterparts in the insurance industry. While each insurance provider has its unique pricing strategy, State Farm stands out with its affordable yet comprehensive coverage options.

Factors Affecting Rates

- Driving record

- Age and gender

- Location

- Vehicle make and model

- Credit score

These factors play a significant role in determining the final insurance rates offered by State Farm. By maintaining a clean driving record and improving your credit score, you can potentially lower your insurance costs with State Farm.

Choosing State Farm Insurance

When it comes to choosing the right insurance provider, State Farm Insurance stands out with its great coverage and affordable rates. With a wide range of insurance options, State Farm is a top choice for individuals and families looking to protect their assets.

Ideal Candidates

State Farm Insurance caters to a diverse range of individuals, making it an ideal choice for various candidates, including:

- New drivers looking for reliable and affordable auto insurance coverage.

- Homeowners seeking comprehensive protection for their property and belongings.

- Renters in need of insurance coverage for personal liability and belongings.

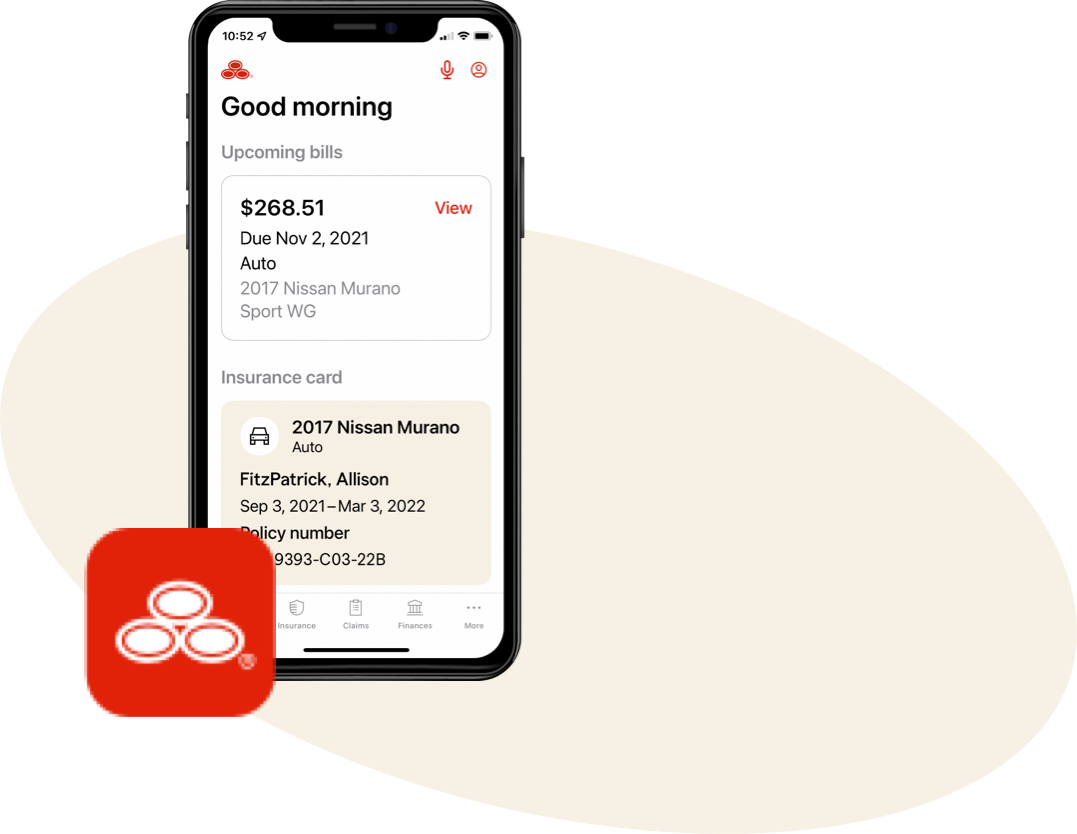

Online Account Management

State Farm Insurance provides convenient online account management, allowing policyholders to have easy access to their insurance information. With an online account, you can:

- View and manage your policies.

- Make payments and set up automatic bill pay.

- File and track claims.

- Access digital insurance cards.

- Update personal information.

By utilizing the online account management system, you can have full control over your insurance policies, making it easier to stay organized and informed.

Credit: newsroom.statefarm.com

Local State Farm Agents

When it comes to insurance, having a reliable and knowledgeable agent by your side can make all the difference. State Farm Insurance understands the importance of personalized service, which is why they have a network of local agents ready to assist you with your insurance needs. Let's take a closer look at three of these dedicated agents in Austin, Texas.

Agent 1 - Stuart Nalewaik

If you're looking for an experienced and trustworthy State Farm agent in Austin, Texas, look no further than Stuart Nalewaik. With his extensive knowledge of insurance and commitment to customer satisfaction, Stuart can help you find the best coverage for your unique needs. You can reach Stuart at (512) 382-6019 to schedule an appointment and discuss your insurance options.

Agent 2 - Brad Herrera

Brad Herrera is another excellent choice for State Farm insurance in Austin. With his attention to detail and personalized approach, Brad takes the time to understand your specific requirements and tailor a policy that fits your budget. To schedule an appointment with Brad, give him a call at (512) 892-1200. He offers both onsite services and online appointments for your convenience.

Agent 3 - Nancy Callahan

For reliable and professional assistance with your insurance needs, Nancy Callahan is the State Farm agent to contact. With her expertise and dedication to exceptional customer service, Nancy can help you navigate through the complexities of insurance coverage. You can reach Nancy at (512) 451-7573 to discuss your insurance options and find the best plan for your needs.

Having a local State Farm agent who understands your community and its unique risks is invaluable when it comes to choosing the right insurance coverage. Whether you're looking for auto, home, or any other type of insurance, these agents in Austin, Texas, are ready to provide you with top-notch service and reliable coverage.

State Farm Insurance And Customer Satisfaction

State Farm Insurance is a well-known insurance company that has been providing coverage and peace of mind to customers for decades. One of the key factors that sets State Farm apart from its competitors is its commitment to customer satisfaction. State Farm takes pride in providing excellent service and ensuring that its customers have a positive experience throughout their insurance journey.

Comparison With Allstate

When it comes to comparing State Farm Insurance with its competitors, Allstate is often mentioned alongside. While both companies have similar customer satisfaction ratings, there are some notable differences in their offerings.

Allstate coverage costs almost twice as much as State Farm on average. This price discrepancy may make State Farm a more attractive option for individuals who are looking for affordable insurance without compromising on the quality of coverage.

Additionally, Allstate offers tourist car insurance for travelers in Mexico, a type of coverage that is not available through State Farm. This can be a determining factor for individuals who frequently travel to Mexico and want comprehensive insurance coverage during their trips.

Factors Affecting Customer Satisfaction

Several factors can contribute to customer satisfaction when it comes to insurance. State Farm understands the importance of addressing these factors to ensure that its customers are happy and confident in their insurance coverage.

1. Personalized Service: State Farm Insurance takes pride in providing personalized service to each of its customers. With a network of local agents across the country, State Farm ensures that customers have access to a representative who can address their unique insurance needs and provide guidance throughout the process.

2. Claims Processing: Prompt and efficient claims processing is crucial for customer satisfaction. State Farm Insurance has streamlined its claims process to minimize any inconvenience for its policyholders. From filing a claim to receiving a settlement, State Farm aims to make the process as smooth and hassle-free as possible.

3. Transparent Pricing: State Farm strives to offer competitive and transparent pricing to its customers. Providing clear and detailed information about premium rates, deductibles, and coverage options allows customers to make informed decisions about their insurance plans.

4. Range of Coverage Options: State Farm Insurance offers a wide range of coverage options to cater to various insurance needs. Whether customers are looking for auto insurance, homeowners insurance, or renters insurance, State Farm has customizable plans to meet their specific requirements.

5. Accessibility: Accessibility is a crucial aspect of customer satisfaction. State Farm Insurance provides multiple channels of communication, including online platforms, local agents, and a dedicated customer service team, to ensure that customers can easily reach out for assistance or information.

By focusing on these factors and continuously improving its services, State Farm Insurance strives to exceed customer expectations and create long-lasting relationships based on trust and satisfaction.

State Farm Insurance: Financial Stability

When it comes to choosing an insurance provider, financial stability is a crucial factor to consider. It ensures the company's ability to fulfill its promises and obligations to its policyholders, even in uncertain economic conditions. State Farm Insurance has proven its financial strength and stability over the years, providing customers with peace of mind and confidence in their insurance coverage.

Pacific Life Partnership

State Farm Insurance has established a partnership with Pacific Life, a reputable and financially secure company. This collaboration enhances State Farm's offerings and adds an extra layer of financial strength and security to their insurance products.

Strength And Stability

State Farm boasts a long-standing history of financial stability, backed by its strong financial performance with consistent and reliable returns. This stability not only instills trust in its policyholders but also demonstrates its ability to weather economic fluctuations and provide dependable insurance solutions.

State Farm Insurance: Online Tools

Welcome to State Farm Insurance, where innovation meets convenience. With our range of online tools, managing your insurance needs has never been easier. From obtaining quotes to managing your account, our online platform provides a seamless experience for our customers.

Online Quote Generation

With State Farm Insurance, getting a quote for your insurance needs has never been simpler. Our online quote generation tool allows you to input your details and receive a personalized quote within minutes, helping you make informed decisions about your coverage. Whether it's auto, home, or renters insurance, our intuitive online tool ensures a hassle-free process.

Account Management Features

State Farm Insurance provides a comprehensive suite of online account management features, putting you in control of your insurance policies. From updating personal information to adding new coverages, our user-friendly platform empowers you to manage your account with ease. Our secure online portal ensures that your information is kept safe while providing convenient access to your policy details.

State Farm Insurance: Community Presence

State Farm Insurance values community presence and actively engages with local communities through various initiatives and programs. One of the key aspects of State Farm's commitment to community involvement is seen in its dedicated efforts to support and uplift the areas it serves.

State Farm Center

State Farm Center serves as a hub for community activities and events. It provides a space where residents can gather, learn, and connect. The center is designed to foster a sense of belonging and togetherness among community members.

Community Engagement

State Farm Insurance prioritizes community engagement by partnering with local organizations, sponsoring events, and volunteering their time and resources. Through these initiatives, State Farm demonstrates its commitment to making a positive impact in the neighborhoods it operates.

Credit: www.statefarm.com

Frequently Asked Questions For State Farm Insurance

Who Typically Has The Cheapest Insurance?

State Farm typically offers the cheapest insurance coverage, especially for drivers with violations on record, offering rates below national average.

Is It Better To Own An Allstate Or State Farm?

When comparing Allstate and State Farm, State Farm offers lower average coverage costs and additional tourist car insurance for travelers in Mexico. Customer satisfaction is similar for both companies. State Farm may be a better option for drivers with violations on their record.

Who Gets State Farm's Best Rates?

State Farm offers competitive rates, particularly for drivers with past violations like speeding tickets or accidents, often below the national average.

Why Is Insurance So High?

Insurance is high due to factors such as increased repair costs, supply chain shortages, rising mechanic wages, and advanced vehicle technologies. These factors contribute to higher vehicle and insurance expenses.

Conclusion

State Farm Insurance offers great coverage and rates. Contact a local agent to save on auto, home, and tenant insurance. Switch and save with State Farm today for reliable coverage. Manage your accounts easily online and get a free quote for peace of mind.

Like a good neighbor, State Farm is there.